Metamorphosis: Are We Ready?

Vidya Veerapandian takes a critical look at the level of innovation and transformation within the insurance industry in the UAE.

The UAE’s insurance industry is going through an exciting phase of reinventing itself whilst trying to keep pace with customer expectations, onset by digitisation and the COVID-19 pandemic. Globally as well, insurance is undergoing a large-scale disruptive phase led by large tech companies such as Amazon and Google planning their foray into the insurance business and start-ups rewriting business models.

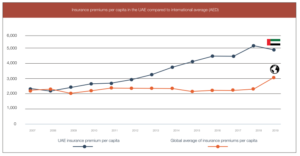

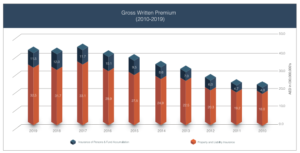

Over the last 10 years, UAE’s insurance business has almost doubled in GWP terms and currently stands at around AED44 billion as of 2019 and UAE ranks higher in comparison to the  international average in terms of insurance per capita.

international average in terms of insurance per capita.

While the ongoing pandemic and digital led disruption may have just pushed the industry its next phase of evolution to keep pace with stagnating growth and increasing competition from digital natives, many experts and customers I speak to resonate with the untapped  potential within the Insurance industry. And to leverage the potential, I believe there are five key levers that are driving change within insurers at varying speeds.

potential within the Insurance industry. And to leverage the potential, I believe there are five key levers that are driving change within insurers at varying speeds.

- Focus on Customer Happiness

The biggest change emerging is a gradual shift of mindset, from being internally focussed on claims, actuarial, GWP, risk analysis etc to being customer focussed. Prompted by digital aggregators and insuretech start-ups, digital customers are expecting a curated customer experience to which they are accustomed, from pure play digital brands such as Airbnb, Uber and Dubai Now, among others.

Of course, it is an ongoing effort but largely delivering greater customer happiness seems to have finally turned the corner. A customer centric attitude alters the entire dynamics both within the business across technicalities, operations, product and obvious customer experience targeted activities. Initiatives such as revamped web and mobile channels, integration of tools such as WhatsApp and other social media channels for customer service and proactive customer engagement are a reflection of this adopted change.

2. Embrace Change Agents

Having designed and managed many projects with multiple insurers, it gave a unique insight into the pace of change. There are the ‘change agents’ and there are the ‘traditionalists’. It  requires consistent evangelising efforts from the ‘change agents’ to articulate and manifest transformation within the organisation. Such change agents need to be nurtured, encouraged and developed both within and externally that would eventually set off change in motion. A great example of this would be many marketing team and marketing leadership initiating revamp of digital touchpoints including getting the buy-in from their respective finance or management on the need for such transformation initiatives.

requires consistent evangelising efforts from the ‘change agents’ to articulate and manifest transformation within the organisation. Such change agents need to be nurtured, encouraged and developed both within and externally that would eventually set off change in motion. A great example of this would be many marketing team and marketing leadership initiating revamp of digital touchpoints including getting the buy-in from their respective finance or management on the need for such transformation initiatives.

3. Be open to ideas from everywhere

In most cases, transformation within the organisation could be triggered either by a specific function or cross-functional need, be it accelerating the speed of claims or improving the retention book or making a first- mover advantage to gain traction within the SME market. Ideas and inspiration to transform could arise from disparate employees and this is being fast recognised within several insurers. Deep insights of the market, competitor landscape, internal readiness and general access to technology and social media empower an organisation’s people with countless ideas and imagination possibilities and harnessing such diverse idea generators could ultimately become a key differentiator for businesses. It is important insurers create platforms that allow them to develop these ideas into prototypes. Mature ones are considering building a regional innovation/ product lab, similar to the ones existing within global companies. Whilst most organisations have made phenomenal progress in enabling many functions and employees to build on ideas, it is yet to be part of the organisational DNA.

4. Agile Tech

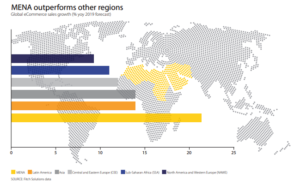

Insurance as a business, whilst being a source of rich data and having used IT systems to compound complex risks, has remained largely lethargic in the last decade or so when it comes to  adopting agile technologies.Currently, the UAE is considered the most advanced eCommerce market in MENA, with a penetration rate of 4.2 and projected eCommerce sales of USD16 billion in 2019 with over 70 percent UAE consumers choosing to shop more online since the onset of COVID-19.

adopting agile technologies.Currently, the UAE is considered the most advanced eCommerce market in MENA, with a penetration rate of 4.2 and projected eCommerce sales of USD16 billion in 2019 with over 70 percent UAE consumers choosing to shop more online since the onset of COVID-19.

Keeping pace with changing consumer behaviours, insurers are shifting from legacy systems to AI, Analytics, Blockchain, IoT and biometric technologies across internal systems and external customer experience touch points. New concepts such as pay-per-use insurance by niche players such as Beema, Hala Insurance and seasoned players such as Policy Bazaar are challenging insurers to innovate their digital and customer experience capabilities.

With customers now being able to compare prices, conduct online research and make purchase decisions much earlier in the buying journey, insurance businesses are now forced to offer discounts, promotions, 24/7 customer support and be proactive to keep competition at bay. Marketing teams are perhaps facing the most pressure to redefine go-to-market models every so often, resulting in a slew of third-party software/tools/SaaS led products being procured by insurers across CRM, digital marketing, analytics and attribution requirements. And this trend seems like it is here to stay as many of the insights and practices that will become available from these tools, which will become the new normal.

Going forward, Insurers are expected to build itself to deal with disruption from four sources:

- Disruption from within the industry – the UAE’s ADQ recently investing close to AED300 million in Policy Bazaar, an established digital insurance organisation from India.

Vidya Veerapandian, founder, FWD

- Disruption from Insurance start-ups – such as Beema’s Pay-per-kilometre insurance and Hala Insurance are good examples of how motor insurance of the future would be built around great customer experience.

- Disruption from e-commerce and other established players – launch of the region’s first independent banking platform, YAP, is a clear indicator for insurers to fast forward their transformation agenda.

- Disruption from tech start-ups – telco, mobility companies, tech companies and big giants such as Google, Facebook, WeChat and GoJek are fast becoming the new ecosystem for customer’s digital lives fulfilling everything from payments, banking, finance, insurance, mobility and a host of everyday life’s needs.

The UAE Government’s Vision 2021 focuses on transitioning to a knowledge-based economy promoting innovation, R&D, strong regulatory frameworks and encouraging entrepreneurship and innovation culture. Insurance, being one of the key contributors to the economy, is undergoing a transformative and awareness phase, opening up new opportunities, enabling innovation and disrupting existing business models; aligning itself well with UAE’s vision of being among the best countries in the world and building a better future for itself and all its stakeholders.

Read more: