IPMI: The Next Wave

Is International Private Medical Insurance enjoying high growth since its beginnings in 2017? Sandhya Divakaran finds out.

International Private Medical Insurance, or IPMI, has been a buzzword since the fourth quarter of 2017 in this region. The demand for qualitative healthcare facilities and increased worker benefits has resulted in this trend. Fast forward to the second quarter of 2018, the question remains, is IPMI doing as well as it should?

There are many considerations to answer this question. Quite generally, IPMI caters to a high net worth population and those who have rich benefit packages among the expatriate segment.

From a customer perspective, the world has become a well-connected, smaller place for insurers. Accessibility, spending power, technology have all advanced and therefore IPMI, while being a premium product, garners quite a bit of attention due to the coverage advantages. In addition, expatriates claim a large chunk of the population figures in the UAE, which makes the country and subsequently a larger part of the Middle East and Africa region quite attractive for such a product.

While emerging markets spell a growing middle class and the resulting push in healthcare, it impacts utilisation of healthcare facilities and therefore insurance services.

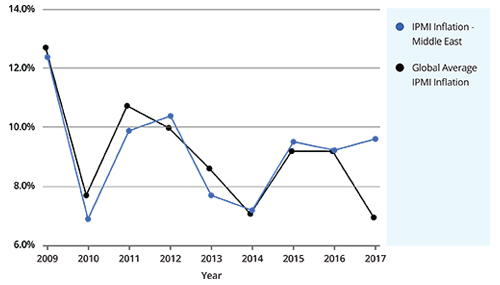

One of the goals of insurers is to find a balance between the benefits that are offered by the policy and its affordability. This is sometimes compromised by competition, medical inflation, all which impact premiums. Cost containment of IPMI while providing stellar healthcare facilities remains the prime goal of the health insurance industry. In fact global IPMI inflation in 2017 was seven percent, according to the 2018 IPMI Inflation Report by Pacific Prime. Within the Middle East, inflation increased from 9.2 percent in 2016 to 9.6 percent, above the global figure of 7.0 percent. There are many drivers for this: increased compliance and regulations such as witnessed in the UAE market; new medical technology, an imbalance of healthcare resources, increased compensation for healthcare professionals; health overutilisation, changing population dynamics (increasing aging population); increasing adoption of non-industry specific technology; and in general, a more favourable global economy.

Many organisations are innovating themselves in order to deal with the competition in IPMI. Education and awareness form a large component of such a campaign. “The evolution of healthcare in the UAE is an interesting one. The government has made health insurance mandatory; people are increasingly health conscious and spend more time on their fitness and wellbeing. As a result of this renewed focus, we expect to see continued growth in the region across the healthcare value chain, including IPMI,” notes Zahir Sharif, managing director, Asia Pacific, Middle East and Africa of Now Health.

Therefore a younger, technology-savvy population is a positive for Now Health. “We see continued diversification in our portfolio and considerable opportunity for a range of IPMI products that can cater to the growing international student marketplace, as well as the increasing number of young expats that move overseas,” Sharif adds.

Therefore a younger, technology-savvy population is a positive for Now Health. “We see continued diversification in our portfolio and considerable opportunity for a range of IPMI products that can cater to the growing international student marketplace, as well as the increasing number of young expats that move overseas,” Sharif adds.

Another avenue of innovation is decentralisation of offices in regional hubs with a focus on local knowledge, talent and compliance, examples of which are Aetna and Cigna. “Localisation and compliance are key to differentiation in this market. From improving access to care to customising plans to meet diverse client requirements, regional products enhance the ability of employers to manage employee costs and expectations across the board,” according to Art Cozad, CEO, Cigna Insurance Middle East. Cigna’s move to acquire Zurich Insurance Middle East has helped in setting up an independent, compliant regional office, which has in turn allowed the organisation to recruit local talent in order to build localised, customisable health products in the region.

“We are very much impacted by local regulations in the UAE. Understanding and complying with local regulations, in whatever region we’re operating in, is a fundamental part of our business,” says David Healy, CEO for EMEA of Aetna International. Aetna has set up a large in-house clinical team and made the Dubai office the headquarters of the EMEA region.

While localisation may contain some of the costs, the insurers cannot control the price of healthcare. Organisations like Aetna and Cigna have improved relations with provider networks and other institutions in order to provide the best facilities to their members. This is key to building the right network for such a global product.

However, in a region such as the UAE, there are many who would like qualitatively superior healthcare facilities, without having to pay for global coverage. Many insurance companies in the UAE have begun discussions on regionalising the “I” in IPMI. “Whilst Aetna International is traditionally an international health insurance provider, we’ve recognised that the market in the Middle East is regional in nature. Many expatriates in Dubai, for example, only want access to the Dubai health care system, so we’re looking to create global products with a regionalised slant,” offers Healy.

Sharif believes that the evolution of healthcare in the region is an interesting one. “Affordability is an interesting topic, especially as we know that more and more millennials want to explore and move abroad, who demand the benefits of a comprehensive international health insurance plan but with an affordable price tag,” he says.

Cozad believes that Cigna has also witnessed a steady increase in the number of multinationals in the region, as well as homegrown companies that are exploring international and regional coverage options for their employees.

One of the big focuses of the IPMI cover remains the wellness and prevention monitoring programmes. This impacts cost containment and adds value to the benefit package, while providing an element of differentiation from the competition. “Competition is always healthy in the IPMI space, and we’re totally comfortable with that. We stay ahead of the game by constantly striving to improve how we serve or members, whether that’s through our approach to wellness, adding leading medical facilities to our network of providers, improving our products or making it easier for our members to access the care they need,” Healy points out.

And many companies fortify the IPMI product with the value that they provide. “While affordability is an important driver in our client and customer relationships, our biggest selling point is not the cost but delivering maximum value at a price point that remains competitive in the marketplace. Moreover, we continuously enhance our expertise in the global market through our investment in market research that allows us to understand customer profiles and the health status of the target population to which we cater. One such effort is the annual Cigna 360o Well-being Survey that we run every year,” says Cozad.

‘Competition is a good thing. It makes you more focused, more responsive, and sharper at executing your strategy. However competition also creates more choice for customers and therefore pricing pressure,” Sharif opines.

Growth

It seems that the results of the companies operating within the IPMI space have paid off, as many organisations within the corporate sector seem to increasingly move to an IPMI product rather than a costly regular health insurance package. “In 2017-18, Now Health registered a growth of 14 percent in the Middle East and Africa region and we continue to focus on expanding our products in Africa including markets such as Kenya,” Sharif adds.

“We’re certainly seeing more corporate clients looking seriously at an international health insurance [package] for their staff. Corporates can choose from a wide range of domestic or international health insurance cover options. Domestic plans can be cheaper but benefit terms are usually more restrictive than international programs. Overall benefit limits tend to be lower and no cover is provided for employees whose job demands frequent travel or overseas relocation,” notes Healy.

Setting up technologically sound processes including claims management teams from a local standpoint have much importance in growing IPMI as a product. While there aren’t many facts to substantiate the growth, the overall voice of the industry suggests that IPMI has witnessed rapid growth and will continue to rise in the next five to ten years.

Industryspeak