‘Alternative capacity grabs 20% marketshare’

A new study from Conning found that reinsurance companies are under pressure from all angles alternative, with the capital markets, captives and government-sponsored entities all taking risk that was once their domain.

The study looks at how buying trends have shifted in the soft reinsurance market and discusses the dynamics of the last decade. Much of that period has been characterised by the rise of the capital markets and ILS funds, but other alternative sources of capacity have also pressured reinsurers, as ceding companies hunt for efficiency.

“Few sectors have undergone as much change in the past decade as the reinsurance market,” explained Matt Sternat, vice president of Insurance Research at Conning. “The lack of catastrophes, inroads from alternative capital, and changing buyer patterns have led to dramatic consolidation and change among reinsurers.”

These trends have led to an adjustment in reinsurance buying patterns, as ceding companies increased the sophistication within which they look at risk transfer and became more discerning about where they source it from.

“Reinsurance buyer behaviour has been mixed, with concentration in reinsurer panels among larger cedants, but more diversification beyond the top 25 buyers,” Sternat continued.

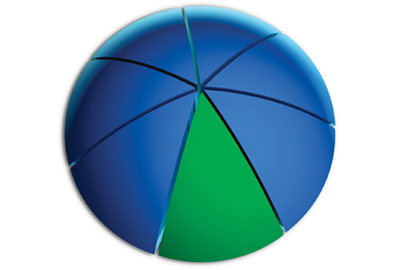

The alternatives have taken a sizeable chunk out of what was the traditional reinsurance market’s domain.

“Even though insurers are ceding a larger portion of their premium, traditional reinsurers lost 20 points of market share in the past ten years, much of it to new captives,” said Steve Webersen, head of Insurance Research at Conning.